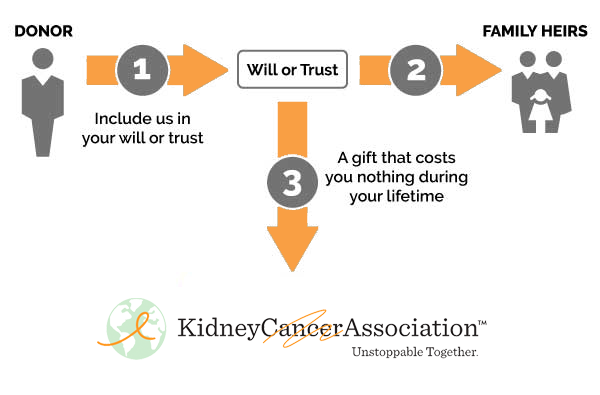

Gifts That Cost You Nothing Now

Gifts in a will or by beneficiary designation are two easy ways to advance life-changing kidney cancer programs and services for years to come — and they don’t cost anything now.

Making a legacy gift in your will or trust is one of the easiest and most popular ways to make a lasting impact for the Kidney Cancer Association. By simply signing your name, you can create a legacy of bringing us closer to a world without kidney cancer.

Once you have provided for your loved ones, we hope you will consider making defeating kidney cancer part of your life story through a legacy gift.

Ready to take the next steps?

A gift in your will is one of the easiest ways to create your legacy and offers the following benefits:

NO COST

Costs you nothing now to give in this way.

FLEXIBLE

You can alter your gift or change your mind at any time and for any reason.

LASTING IMPACT

Your gift will create your legacy of defeating kidney cancers and the suffering they cause.

Four simple, “no-cost-now” ways to give in your will

General gift

Leaves a gift of a stated sum of money to the Kidney Cancer Association in your will or living trust.

Residual gift

Specific gift

Contingent gift

You can mix these no-cost ways together. For example, you might consider leaving a specific percentage (such as 50%) of the residual to the Kidney Cancer Association contingent upon the survival of your spouse.

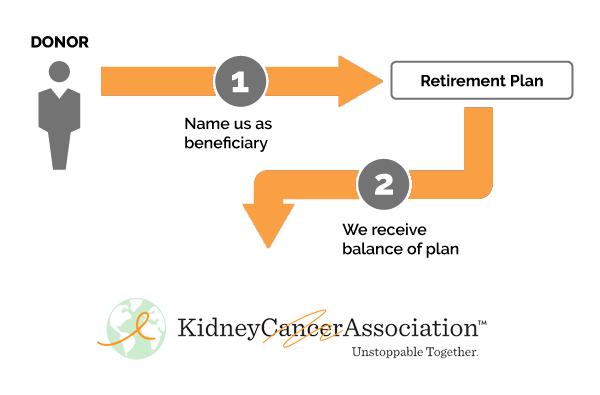

Gifts by Beneficiary Designation

It’s easy to put your bank accounts, retirement funds, savings bonds, and more to use in serving and empowering kidney cancer patients — and it costs you nothing now.

By naming the Kidney Cancer Association as a beneficiary of these assets, you can power our mission for years to come and establish your personal legacy of building a community of support for anyone impacted by kidney cancer.

Potential benefits of gifts by beneficiary designation:

Reduce or eliminate taxes

Reduce or avoid probate fees

No cost to you now to give

Create your legacy with the Kidney Cancer Association

To name the Kidney Cancer Association as a beneficiary of an asset, contact the custodian of that asset to see whether a change of beneficiary form must be completed.

How to change a beneficiary designation:

Login to your account or request a Change of Beneficiary Form from your custodian (the business holding your money or assets).

Follow the links to change your beneficiary or fill out the form.

Be sure to spell the name of our organization properly: Kidney Cancer Association

Include our tax identification number: 36-3719712

Save or submit your information online or return your Change of Beneficiary Form.

Types of Gifts

A gift of retirement funds

You can simply name the Kidney Cancer Association as a beneficiary of your retirement plan to further kidney cancer advocacy efforts.

A gift of funds remaining in your bank accounts, brokerage accounts or certificate of deposit (CD)

This is one of the easiest gifts to give and one of the most useful in accomplishing your philanthropic goals. The next time you visit your bank, you can name the Kidney Cancer Association (Tax ID: 36-3719712) as the beneficiary of a checking or savings bank account, a certificate of deposit (CD), or a brokerage account. When you do, you’ll take a powerful step toward eliminating kidney cancer for future generations.

Donor-Advised Fund (DAF) residuals

What remains in a donor-advised fund is governed by the contract you completed when you created your fund. When you name the Kidney Cancer Association as a “successor” of your account or a portion of your account value, you enable lifesaving research and supportive care.

Savings bonds

If you have bonds that have stopped earning interest and you plan to redeem them, you might owe income tax on the appreciation. That could result in your heirs receiving only a fraction of the value of the bonds in which you invested. Since the Kidney Cancer Association is a tax-exempt institution, naming us as a beneficiary means that 100% of your gift will go toward invaluable resources, education, and services for kidney cancer patients.